• Student loan borrowers cannot apply for the loan forgiveness program now.

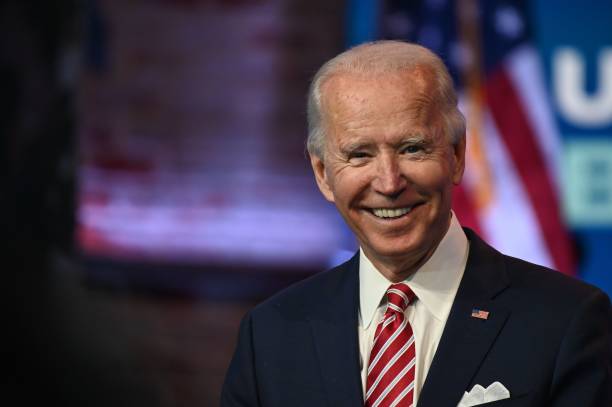

• On Thursday night, a federal judge in Texas invalidated the Biden administration’s proposal.

• According to Harvard law scholar Laurence Tribe, the decision “was about as erroneous and bizarre as any federal court ruling I can recall reading.”

Following a court’s rejection of the Biden administration’s plan, On Thursday night, the government has ceased to accept applications for students loan forgiveness program.

There is a notice on the website studentaid.gov for the student loan forgiveness, that reads, “Courts have issued orders to stop our student loan forgiveness programme.” “As a result, we are not accepting applications at this time. We are trying our best to have the orders reversed.

A federal judge in the state of Texas recently denied President Joe Biden’s executive step to waive off up to $20,000 in student loan for millions of Americans students, prompting the suspension of the forgiveness programme.

In the 26-page ruling, Judge of the U.S. District Court for the Northern District of Texas, Mark Pittman stated that our country is not run by an all-powerful executive with a pen and a phone. In 2019, the former President Donald Trump appointed the judge Mark Pittman, who sided with the Job Creators Network Foundation, a conservative advocacy organisation.

The group accused the president of abusing his power by labelling Biden’s proposal “irrational, arbitrary, and unfair.” In the complaint, it was claimed that by not soliciting public feedback on its initiative, the White House flouted federal regulations.

The Department of Justice has already challenged the ruling in the court, according to the recent updates from Biden administration.

The Biden’s Student Loan Waiver Plan, according to Education Secretary Miguel Cardona, “is legal and very important to provide the students and working families breathing room as they are recovering from the pandemic and to guarantee they succeed when payments commences.” “We are not backing down despite attempts to thwart our debt waiver scheme.”

The biggest obstacle for anyone intending to bring a lawsuit against Biden’s plan has been finding a plaintiff who can prove they have been harmed by the policy.

According to Laurence Tribe, ( Harward Law Professor ), The establishment of what the courts has referred to as “standing” requires such an injury.

Tribe claimed that this is why he was astounded by the Texas judge’s decision.

According to Tribe, “Judge Pittman’s decision was about as absurd and incorrect as any federal court decision I can remember reading.” He made a mistake by ruling on the merits without first determining which of the two plaintiffs had standing.

Obstacles for Biden’s Student loan forgiveness plan

Six states with Republican governors already oppose the president’s plan to do away with student loan debt: Nebraska, Missouri, Arkansas, Iowa, Kansas, and South Carolina. Additionally, these states asserted that the president had overstepped his authority.

A federal judge dismissed the states’ complaint, claiming that while they highlighted “important and significant issues to the debt relief system,” they lacked the legal right to pursue the claim.

The Republican-led states did not quit up when their case was dismissed. They sought in their appeal that the president’s plan, which was set to begin in October, be halted while their case was evaluated.

The 8th U.S. Circuit Court of Appeals granted the states’ emergency appeal, stopping the Biden administration from commencing to cancel student debt.

Nonetheless, the Education Department has advised borrowers to continue asking forgiveness because its plan has not yet been reversed.

26 million borrowers have applied for forgiveness

On August 24, Biden said that tens of millions of Americans would be eligible for student loan forgiveness, with sums ranging from $10,000 to $20,000 depending on whether or not they were Pell Grant winners, a type of financial aid available to low-income families.

Long before Biden took action in response to consumer activists and other Democrats, Republicans decried student loan cancellation as a gift to wealthy college graduates. They claimed that without the permission of Congress, the president lacked the jurisdiction to forgive consumer debt.

As expected, the legal challenges poured in. So far, at least 6 different cases have been registered against the president’s plan.

Initially, the Education Department said that borrowers would be forgiven six weeks after applying. The entire application went live on October 17, and within three weeks, almost 26 million people had requested aid. So far, 16 million such applicants have had their requests granted.

The government has stated that it will temporarily hold the applications of borrowers who have already applied.

Borrowers should wait it out, according to higher education analyst Mark Kantrowitz.

According to Kantrowitz, “the programme has been suspended, but the US Department of Education is appealing; there were a number of peculiar aspects of the Texas court’s decision that may lead to a successful appeal.”

Thanks for visiting our website usdailyupdates.com

student loan forgiveness, new student loan forgiveness, federal student loans loan forgiveness, taxes on student loan forgiveness, private student loan forgiveness, what is student loan forgiveness, student loan forgiveness scams, student loan forgiveness application 2022, student loan forgiveness programs, student loan forgiveness plan, student loan forgiveness plan

US DAILY UPDATES

1 thought on “Student loan forgiveness program – Why the Biden administration has stopped accepting applications?”